The Australian Financial Complaints Authority (AFCA) will generally try to first resolve a complaint by informal methods and reach a settlement between you and the financial firm through negotiation or conciliation.

However, if we make a formal decision, there are a number of outcomes – also called ‘remedies’ – that we can provide under our Rules.

Find out more about our complaint resolution process, including when we will make a decision.

Section D of our Rules and Operational Guidelines provides greater detail about remedies, and when we can apply them.

Remedies for general complaints

We may decide that a financial firm or complainant must undertake a course of action to resolve a complaint. We will only provide a remedy if we decide that you have incurred loss or harm that was caused by the financial firm’s conduct.

Some of the remedies we can award have financial value and others do not, and the examples provided on this page are not exhaustive. We may decide another outcome is more appropriate. We can’t impose punitive, exemplary or aggravated damages.

When deciding on the remedy, we often seek to achieve, as nearly as possible, either:

- to place you in the position you would have been in if the conduct of the financial firm had not caused the loss; or

- to compensate you for your loss to the extent AFCA holds the financial firm responsible for the loss.

Examples of outcomes we can provide

Some examples of remedies include:

- the payment of a sum of money

- the forgiveness or variation of a debt

- the release of security for debt

- the repayment, waiver or variation of a fee or other amount paid to, or owing to, the financial firm or to its representative or agent including the variation in the applicable interest rate on a loan

- the reinstatement, variation, rectification or setting aside of a contract

- the meeting of a claim under an insurance policy by, for example, repairing, reinstating or replacing items of property

- in the case of a complaint involving a privacy issue with an individual – that the financial firm should not repeat conduct on the basis that it constitutes an interference with the privacy of an individual or that the financial firm should correct, add to or delete information pertaining to the complainant

- in relation to a default judgment, not enforcing the default judgment

- in relation to privacy-related complaints, to make an order that is generally consistent with the declarations available to the Information Commissioner when they make a decision under section 52 of the Privacy Act

- an apology.

Remedies in cases of financial difficulty

In a financial hardship complaint, the remedies we can provide include varying the credit contract.

Examples of credit contract variations include:

- extending the period of the contract and reducing the amount of each repayment due under the contract

- postponing repayments under the contract for a specified period

- changing payment arrangements for either a short or longer term

- reducing the loan interest rate for either a short or longer term.

If we conclude that there has been a breach of the credit provider’s obligations to provide financial hardship assistance, we will also consider whether the complainant has suffered any financial or non-financial loss. Financial loss might result from default charges or enforcement costs that could have been avoided if the credit provider complied with its obligations. Non-financial loss might include unnecessary stress or inconvenience.

Our Operational Guidelines provide detailed information about remedies in section D.

Compensation for general complaints

We may decide that the financial firm has to compensate you for direct financial loss. When calculating the value of this type of remedy, we include monetary compensation and any remedy where the value can readily be calculated, such as the waiving of a debt.

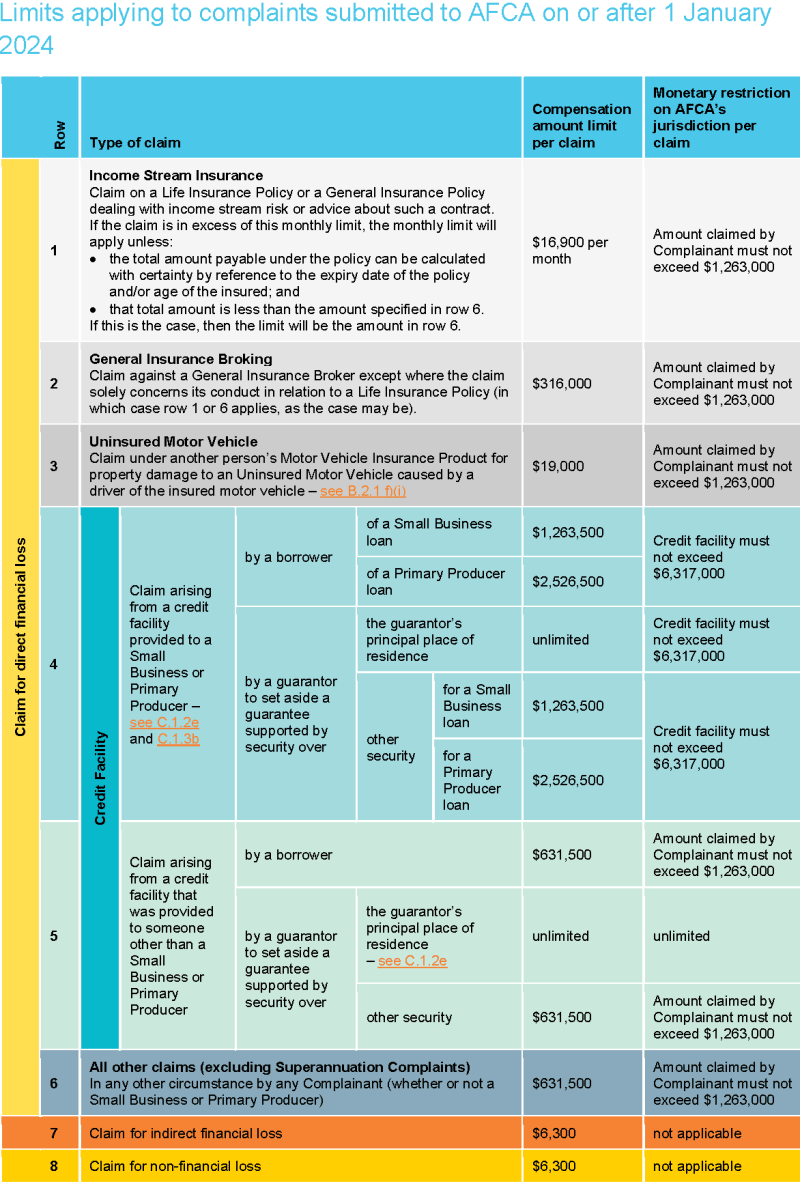

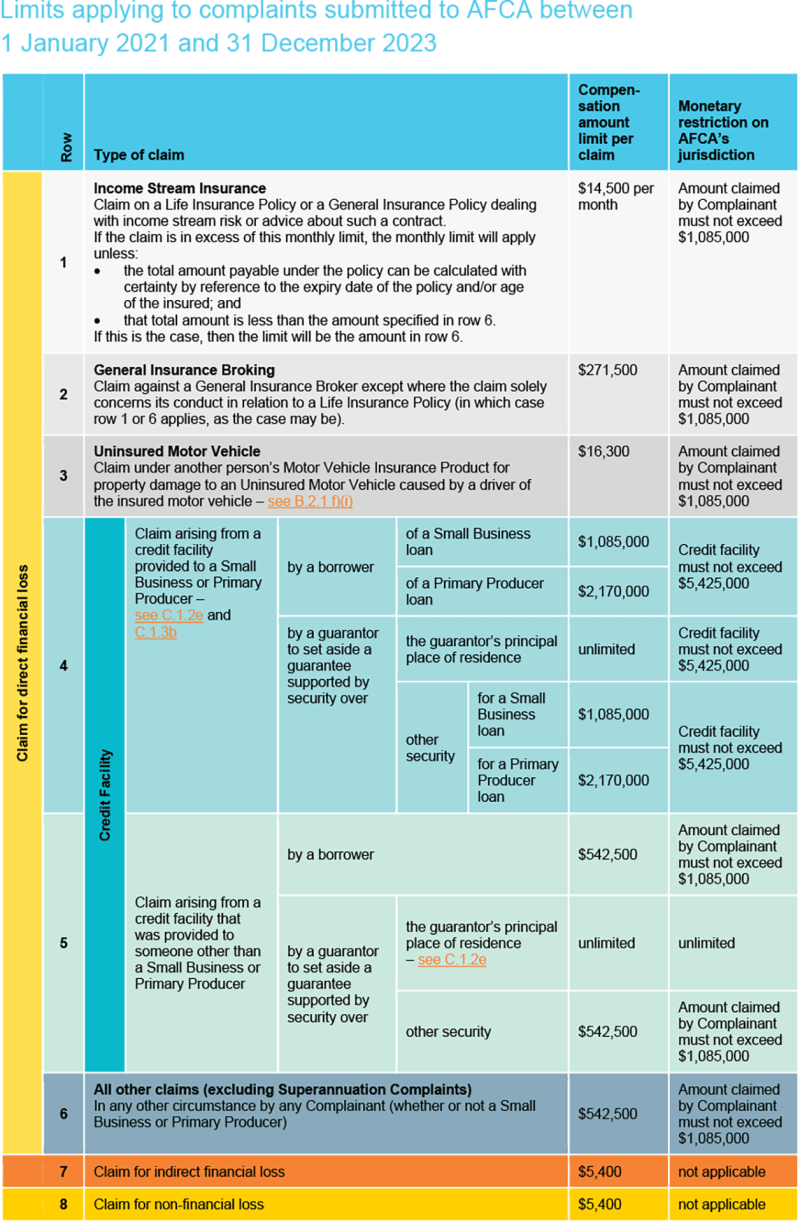

In addition, or instead, we may decide that the financial firm is to compensate for indirect financial loss. This is capped at $5,400 per claim for complaints lodged between 1 January 2021 and 31 December 2023. Compensation is capped at $6,300 per claim for complaints lodged on or after 1 January 2024.

We may also decide that the financial firm should compensate you for non-financial loss. Compensation for non-financial loss is capped at $5,400 per claim for complaints lodged between 1 January 2021 and 31 December 2023. Compensation is capped at $6,300 per claim for complaints lodged on or after 1 January 2024.

We may also make a decision about awarding costs relating to pursuing your complaint, or interest. Our Rules and the Operational Guidelines provide more information.

Read our Operational Guidelines for detailed information on how we approach awarding compensation.

The following table specifies the maximum amounts we can award for complaints other than superannuation complaints. It also outlines the monetary restrictions on our jurisdiction.

Monetary limits for general complaints

Note: This text is reproduced, based or adapted from AFCA's Operational Guidelines.

To see the monetary limits application before 1 January 2021, click here

Remedies for superannuation complaints

Our powers to determine superannuation complaints are set out in section 1055 of the Corporations Act and are summarised in rules D.1.1 and D.1.2.

- When we determine a Superannuation Complaint, we have all of the same powers, obligations and discretions of the trustee, insurer or RSA provider who made the decision or engaged in the conduct complained of.

- If we are satisfied that the decision or conduct was fair and reasonable in all the circumstances, we must affirm it.

If not, we must decide if:

- the decision is unfair or unreasonable in its operation in relation to the complainant (that is, the person making the complaint) in all the circumstances

- the conduct is unfair or unreasonable.

If we are satisfied that the decision or conduct is unfair or unreasonable, or both, then we may do any of the following:

- vary the decision;

- set aside the decision and;

- substitute the decision; or

- remit the decision to the person who made it with any directions or recommendations.

If the decision relates to the payment of a death benefit, we must decide if the decision is unfair or unreasonable in its operation in relation to the complainant and any other interested party who has been joined to the complaint.

What is fair and reasonable depends on the circumstances. There may be a range of decisions that could be considered fair and reasonable. If the trustee’s decision falls within that range, it must be affirmed.

In determining superannuation complaints, AFCA decision makers consider all of the available information to see whether there are adverse practical outcomes or consequences of a decision for the complainant (and joined parties, in the case of a death benefit payment decision).

While there is no monetary limit for superannuation, our powers to provide a remedy can only be used for the purpose of placing the complainant as nearly as practicable in a position that any unfairness or unreasonableness no longer exists.

Remedies we can’t provide for superannuation complaints

We cannot make a decision that is:

- contrary to law

- contrary to the governing rules of a superannuation fund or an approved deposit fund (except to the extent permitted to redress an unfair or unreasonable admission to a life policy fund)

- contrary to the terms and conditions of an annuity policy, a contract of insurance or RSA (except to the extent permitted to redress an unfair or unreasonable sale of the product).

This means that we cannot provide a remedy that would:

- require a trustee, insurer or RSA provider to act contrary to other laws, such as superannuation or taxation legislation

- require a trustee, insurer or RSA provider to act contrary to the relevant trust deed, insurance policy or RSA contract – for example, where a particular decision was required under the governing document, we cannot substitute a different decision unless the trustee could have lawfully made a different decision.

Compensation for superannuation complaints

The compensation set out in rule D.3 and the monetary caps in rule D.4 do not apply to superannuation complaints, however, we can consider whether it was unfair or unreasonable for a trustee not to settle a claim or take a different approach to the claim. We may apply a remedy that results in the payment of compensation to a complainant in respect of losses they have suffered.

Note: This text is reproduced, based or adapted from AFCA's Operational Guidelines.