AFCA’s Six Month Report is an analysis of the complaints received and resolved by the financial complaints body.

Key statistics include:

- 35,263 complaints received

- 60% of complaints resolved

- 74% of complaints were resolved by agreement or in favour of the complainant

- 88% of financial firms did not have a single complaint lodged against them

- $83m obtained in settlements. Note: This includes matters previously received by AFCA’s predecessor, Financial Ombudsman Service, and resolved by AFCA since 1 November 2018.

1 Strategic approach and goals

Purpose

To provide fair, independent and effective solutions for financial disputes.

Vision

To be a world class ombudsman service

- raising standards and minimising disputes

- meeting diverse, community needs, and

- trusted by all

Strategy

Working with consumers, small business and industry, we will resolve and reduce financial disputes through innovative solutions, education and communication.

We will deliver to the Australian community services that are easy to use, free for complainants, efficient, timely and impartial.

Goal

Australian community and government

A fair, ethical and trusted service that influences reform in the financial services sector

Consumers and small business

An excellent customer experience that meets diverse needs and delivers fair outcomes

Members

A valued member experience that helps members to improve internal practices to avoid or resolve disputes

Our people

Highly skilled and engaged people with the tools they need to deliver high quality outcomes

Values

- Fair and independent

- Transparent and accountable

- Honest and respectful

- Proactive and customer focused

3 Six months at a glance

74% complaints were resolved by agreement or in favour of complainants

Complaints received by top five products*

|

Product |

Total |

|---|---|

|

Credit cards |

5,191 |

|

Home loans |

2,921 |

|

Personal loans |

2,704 |

|

Motor vehicle - comprehensive |

1,789 |

|

Personal transaction accounts |

1,236 |

Complaints received by top five issues*

|

Issue |

Total |

|---|---|

|

Credit reporting |

2,286 |

|

Unauthorised transactions |

2,127 |

|

Delay in claim handling |

1,982 |

|

Incorrect fees/costs |

1,816 |

|

Denial of claim |

1,792 |

Complaints received by product line

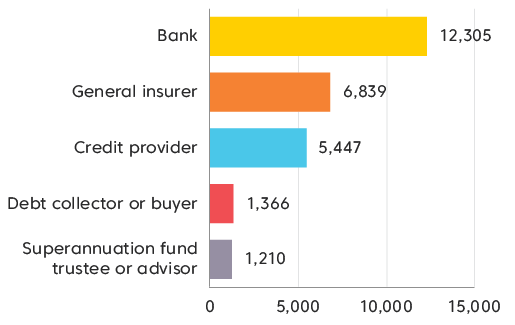

Complaints received by top five financial firm type

87.7% of members had no complaints lodged against them in the first six months

Of the members who had complaints:

- 64 per cent were resolved by the financial firm

- 10 per cent were resolved after negotiations or conciliation

- 3 per cent were resolved after a preliminary view or determination

- Of those that were resolved after a preliminary view, 70 per cent were in favour of the financial firm

- Over 72 per cent of the determinations issued were in favour of the financial firm.

Who lodged complaints

AFCA operates a national dispute resolution scheme for financial services.

Overall, the numbers of consumers and small businesses who made complaints in each state or territory was relatively consistent with that state or territory's population proportionate to Australia's total population.

Complaints received by location

Complaints received by gender

Complaints received by age

2% of our complainants identified as being of Aboriginal or Torres Strait Islander origin.

5 Investments and advice

1,684 investments and advice complaints received. 5% of all complaints received

43% investments and advice complaints were resolved

66% investments and advice complaints resolved within 60 days

57% complaints were resolved by agreement or in favour of complainants

Top 5 investments and advice products

|

Product |

Total |

|---|---|

|

Foreign exchange |

402 |

|

Self-managed superannuation fund |

160 |

|

Shares |

138 |

|

Mixed asset fund/s |

136 |

|

Timeshare schemes |

68 |

Top 5 investments and advice issues

|

Issue |

Total |

|---|---|

|

Failure to follow instructions/agreement |

350 |

|

Inappropriate advice |

229 |

|

Failure to act in client's best interests |

141 |

|

Incorrect fees/costs |

133 |

|

Service quality |

93 |

AFCA received 1,684 investments and advice complaints in our first six-months, which made up five per cent of total of complaints received. This is a 69 per cent increase on investment and advice complaints received by FOS (998) over the same period.

We have seen a sharp increase in complaints about foreign exchange trading accounts, which is an area that has also been receiving recent media attention. Complaints about these accounts cover a range of issues, including difficulty withdrawing funds, misleading conduct, pricing errors and discretionary trading.

We received 402 foreign exchange complaints, which accounted for 24 per cent of all investment complaints. Almost 55 per cent of these foreign exchange complaints were against one financial firm who had their Australian Financial Services Licence suspended by Australian Securities and Investments Commission (ASIC) but remains a member of AFCA, which enables AFCA to deal with complaints.

We also received a high number of complaints about financial advice, including 350 complaints about failure to follow instructions/agreement, 229 complaints about inappropriate advice and 141 complaints that the advisor failed to act in their client's best interest. One of the issues highlighted by the Royal Commission was fees charged by financial advisors where no service was provided. We received 133 complaints about incorrect fees.

7 Life insurance

879 life insurance complaints received. 2% of all complaints received

48% life insurance complaints were resolved

55% life insurance complaints resolved within 60 days

59% complaints were resolved by agreement or in favour of complainants

Top five life insurance products

|

Product |

Total |

|---|---|

|

Income protection |

276 |

|

Term life |

105 |

|

Funeral plans |

71 |

|

Total and permanent disability |

66 |

|

Trauma |

63 |

Top five life insurance issues

|

Issue |

Total |

|---|---|

|

Denial of claim |

113 |

|

Incorrect premiums |

101 |

|

Delay in claim handling |

73 |

|

Claim amount |

68 |

|

Cancellation of policy |

54 |

In the first six months, AFCA received 879 complaints about life insurance, which makes up 2 per cent of total complaints received.

In comparison with the same period last year, life insurance complaints have increased 28 per cent, from 685 under FOS. The increase may partially be driven by an increase in complaints about level premium increase for income protections policies, which are up 52 per cent from 182 under FOS to 276 under AFCA. Some of this increase appears to be driven by a general misunderstanding among consumers about how level premiums work. In our view, the life insurance industry could be doing more in terms of the information provided at the time of taking out the policy to help consumers understand this better.

9 Financial difficulty

Financial difficulty complaints occur when consumers unexpectedly cannot meet their repayment obligations. This may be because of an accident, separation, sickness, natural disaster, death of a family member, unemployment or other factors.

AFCA accepts financial difficulty complaints from both individuals and small businesses relating to a range of credit products and services, such as credit cards, home loans, personal loans and business loans.

In the first six months of operations, we received 3,831 complaints that involved financial difficulty compared with 2,086 complaints for the same period at the predecessor schemes.

We anticipate even higher levels of financial difficulty complaints as the awareness of AFCA increases.

We find that the best solutions occur when the parties work together to develop a plan for overcoming financial difficulty. For this reason, we encourage the parties to be willing to communicate and exchange information with each other.

11 Systemic issues

AFCA has obligations to identify, refer and report systemic issues and contraventions of the law, which we take very seriously. During our first six months of operation, we identified 16 potential serious contraventions and other breaches. At the end of April we also had 85 definite systemic issue investigations open.

A systemic issue is one that has implications beyond an individual complaint. The issue may have been raised in one or more complaints or we may have identified it through other information we have received.

Common issues we are currently investigating include:

- Misleading conduct

- Conduct of employee/authorised representatives

- Adequacy of claims handling process

- Processing errors

Resolved systemic issues

Some of the outcomes from systemic issues that have been resolved include:

- A financial firm was found to be incorrectly assessing whether a consumer had been taking 'reasonable precautions', resulting in a disproportionate amount of insurance claim denials. The financial firm agreed to reopen and pay 197 previously denied claims.

- A financial firm made amendments to its financial hardship policies allowing for individual borrowers to enter into an arrangement without also requiring the consent of a co-borrower. AFCA's concern arose from a number of matters where family violence related issues were a direct barrier to the borrower accessing financial hardship assistance from the financial firm.

- A financial firm implemented significant changes to its online insurance application process, providing greater clarity to consumers regarding their duty of disclosure.

- A financial firm made significant improvements to its client qualification suitability questionnaire for people applying for Contracts for Difference trading accounts.

- A financial firm identified errors in the application of multi-policy discounts for a number of policy holders. Refunds totaling $90,153, plus interest, were paid to impacted consumers.

Positive outcomes from rejected systemic issues

Sometimes we investigate issues that are ultimately determined not to be systemic. The issue may involve substantial investigation and result in a change to a financial firm's process or comment from a Lead Ombudsman about relevant industry practice.

- A financial firm made improvements to its processes in providing suitability assessment, where it is required in response to a complaint.

- A financial firm implemented a series of internal training sessions relating to the importance of its responsible lending obligations.

- A financial firm implemented a series of processes and safeguards to ensure compliance with its obligation to cease debt collection activity while an AFCA complaint is open.

- A financial firm is implementing additional training across its branch network regarding the logging and improved management of complaints. In addition, its policies have been amended to include a calculation of interest in circumstances where it pays financial compensation to a consumer.

- A financial firm will be making improvements to its online banking portal to improve consumer understanding regarding loan repayments required.

13 Member services

Proposed member services offering

Our purpose is to provide fair, independent and effective solutions for financial complaints. We understand that resolving complaints in a fair and timely manner is by far the most important service we can offer.

We also want to provide a valued member experience that helps members improve internal practices to avoid and resolve disputes. To achieve this goal we are developing a plan to deliver member services such as:

- internal dispute resolution training workshops

- case study workshops

- best practice seminars

- improved online written resources including approach documents and case studies

- increased access to benchmarking reports.

Research insights

We recently concluded member research in partnership with a research company, Kantar Public, who facilitated member workshops and conducted an online survey of our members. The final report indicates that members want to see:

- improvements to our online member portal, Secure Services

- current and relevant case studies

- clarity around the AFCA approach to common complaint issues

- feedback on performance.

15 Business improvement highlights

We are committed to understanding the needs of consumers and small businesses and ways we can improve our service. We have implemented a number of improvements to ensure we deliver outstanding service to complainants.

We are running a series of workshops to educate our staff about embedding 'helpfulness' into everything we do at AFCA. Consumers and small businesses often don't have the time, resources or documentation that large financial organisations have and so it is essential that we are helpful to them by providing flexibility in our processes and recognising potential barriers they may face in meeting our timeframes or requirements.

Over 200 staff so far have attended the workshops, with more to attend in the future. The workshops are also now part of our standard induction process for new staff.

We have hired a call quality coach for the contact centre to ensure we maintain a high-quality service and we are proactive resolving any issues with our service.

We are trialling progressive surveys of complainants to understand their experience throughout the process rather than just at the end.

17 Royal Commission

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry handed down its final report to the Governor-General on 1 February 2019. This substantial report marks an important milestone for financial services in Australia, containing 76 recommendations. In February, the Government announced it is taking action on all 76 recommendations.

There were two recommendations that directly related to AFCA, which the Government has responded to:

Compensation scheme of last resort

We were very pleased that the Government announced a compensation scheme of last resort. This is a scheme that AFCA and the predecessor schemes have been long-standing advocates of for over 10 years.

A compensation scheme of last resort is an important backstop that ensures that people who have been the victims of misconduct, and lost out through no fault of their own, can finally be properly compensated. Consumers who have fairly been awarded compensation will finally receive the redress they deserve. The compensation scheme of last resort will provide compensation in the future for consumers who have received a decision from AFCA or a court or tribunal in their favour, but who have not received their compensation due to the financial firm ceasing business.

The Government will also be funding $30 million to cover the payment of legacy unpaid determinations from the FOS and CIO.

Financial firms required by law to cooperate with AFCA

On 6 April 2019, the Government’s announced that financial firms will be required by law to cooperate with AFCA to resolve financial complaints.

This was an important step in ensuring consumers and small businesses have their financial complaints solved effectively and efficiently. AFCA expects all financial firms to cooperate fully and respond promptly and comprehensively to all requests.

Redress for legacy disputes

In the Government’s response to the Royal Commission it, announced that AFCA’s jurisdiction would be increased.

Australian consumers and small businesses who have suffered from misconduct by financial firms but have not yet been heard, will be able to take their cases to AFCA and have them considered. The Government has announced that AFCA’s remit will be expanded for a period of 12 months to accept financial complaints about conduct going back to 1 January 2008.

We will consider eligible complaints between 1 July 2019 and 30 June 2020, after the AFCA Rules have been revised. This is a positive step which means that many more people will be able to get access to justice and have their matters properly considered.

Disclaimer: All statistics in this report are from 1 November 2018 to 30 April 2019, unless otherwise specified.