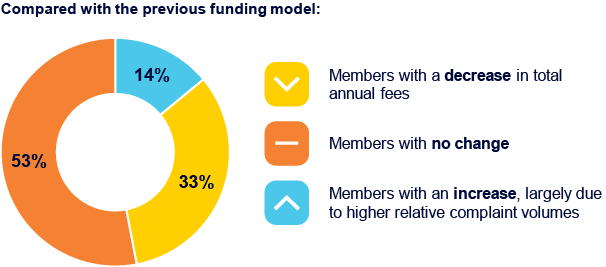

The majority of licensee Banking and Finance members (89%) will either experience reduced or the same total annual fees under the new funding model. 1

86% will only pay the annual registration fee

The new funding model recalibrates funding toward those who use AFCA’s services most frequently.

Therefore banks – as one of AFCA’s largest user sectors – will be one of the biggest contributors under the new funding model. Increases in total annual fees is largely driven by higher complaint volumes and complexity of those complaints, relative to other members.

In the banking and finance industry, 77% of AFCA’s revenue from B&F members under the new model are recovered from very large businesses who represent 12% of all B&F members and 74% of all B&F complaints received by AFCA.

Where a member does a good job of resolving complaints at IDR, they will see a reduction in their overall costs.